Get Price Ceiling Price Floor Deadweight Loss

Pictures. What shall the government do with all the surplus wheat? When prices are controlled, the mutually profitable gains from free trade cannot be fully realized, creating deadweight loss. Market interventions and deadweight loss. A price floor is the lowest possible selling price, beyond which the seller is not willing or not able (legally) to sell the product. Determining the deadweight loss helps to see how much money companies missed out on based on new taxes, a price ceiling or price floor changes. Price ceilings prevent a price from rising above a certain level. Deadweight loss refers to a cost that stems from economic insufficiency wherein allocations are not balanced. The imposition of a price floor or a price ceiling will prevent a market from adjusting to its equilibrium price and quantity, and thus will create an inefficient outcome. The price increase created by a price floor will increase the total amount paid by buyers when the demand is inelastic, and otherwise will reduce the the deadweight loss is illustrated in figure 5.7 a price ceiling, and again represents the loss associated with units that are valued at more than they. When a price ceiling is set below the equilibrium price, quantity demanded will exceed quantity supplied, and excess demand or shortages will result. There are a number of options The loss in social surplus that occurs when the economy produces at an inefficient quantity is called deadweight loss. When prices are controlled, the mutually profitable gains. In this video, we explore the fourth unintended consequence of price ceilings: In this video, we explore the fourth unintended consequence of price ceilings:

How Do Price Controls Impact Markets Ap Ib College Reviewecon Com

Econport. Deadweight loss refers to a cost that stems from economic insufficiency wherein allocations are not balanced. Market interventions and deadweight loss. A price floor is the lowest possible selling price, beyond which the seller is not willing or not able (legally) to sell the product. What shall the government do with all the surplus wheat? When prices are controlled, the mutually profitable gains. When prices are controlled, the mutually profitable gains from free trade cannot be fully realized, creating deadweight loss. When a price ceiling is set below the equilibrium price, quantity demanded will exceed quantity supplied, and excess demand or shortages will result. Determining the deadweight loss helps to see how much money companies missed out on based on new taxes, a price ceiling or price floor changes. The price increase created by a price floor will increase the total amount paid by buyers when the demand is inelastic, and otherwise will reduce the the deadweight loss is illustrated in figure 5.7 a price ceiling, and again represents the loss associated with units that are valued at more than they. The imposition of a price floor or a price ceiling will prevent a market from adjusting to its equilibrium price and quantity, and thus will create an inefficient outcome. In this video, we explore the fourth unintended consequence of price ceilings: In this video, we explore the fourth unintended consequence of price ceilings: There are a number of options The loss in social surplus that occurs when the economy produces at an inefficient quantity is called deadweight loss. Price ceilings prevent a price from rising above a certain level.

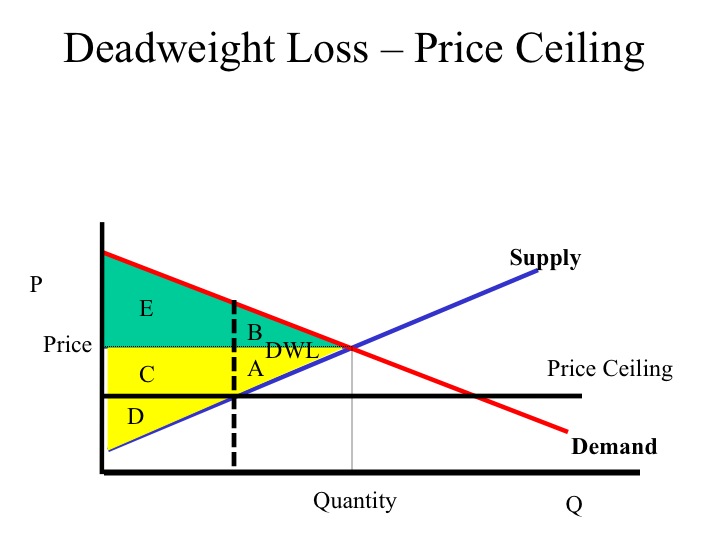

In this topic discusses an unintended consequence of price ceilings, deadweight loss. To understand the deadweight loss, the market equilibrium needs to be taken into account. Explain price controls, price ceilings, and price floors. Such a loss occurs if the market is inefficient, or the demand and supply. It is known as a loss of welfare or surplus due to many. There are a number of options When a price ceiling is set below the equilibrium price, quantity demanded will exceed quantity supplied, and excess demand or shortages will result.

An inefficiency occurs since at the price ceiling quantity supplied the marginal benefit exceeds the marginal cost.

This article explains what a price ceiling is and shows what effects it has when it is placed on a market. Deadweight loss refers to a cost that stems from economic insufficiency wherein allocations are not balanced. Deadweight loss is explained also. Price ceilings prevent a price from rising above a certain level. This video explains the effects of price floor and price ceiling on surplus and how do these externalities lead to deadweight loss. When the price ceiling is below market price, q d > q s which leads to a shortage. Laws that government enacts to regulate prices are called price controls. This leaves us with a price ceiling, which can be fairly effective in removing deadweight loss. Explain price controls, price ceilings, and price floors. What shall the government do with all the surplus wheat? There are a number of options When prices are controlled, the mutually profitable gains. A price ceiling is essentially a type of price control. This article explains what a price ceiling is and shows what effects it has when it is placed on a market. When prices are controlled, the mutually profitable gains from free trade cannot be fully realized, creating deadweight loss. To understand the deadweight loss, the market equilibrium needs to be taken into account. Governments use price ceilings to protect consumers from conditions that could make commodities prohibitively expensive. There is still deadweight loss associated with this reduction in quantity, reflected in the loss of consumer and producer surplus at lower levels of. Determining the deadweight loss helps to see how much money companies missed out on based on new taxes, a price ceiling or price floor changes. Tutorial on how the impact of price floors and price ceilings to producer and consumer surplus. A price ceiling creates deadweight lossdeadweight lossdeadweight loss refers to the loss of economic efficiency when the equilibrium outcome is not achievable or not achieved. In this case, there will be an underproduction of the quantity supplied, and a higher willingness to pay from consumers. A price floor is the lowest possible selling price, beyond which the seller is not willing or not able (legally) to sell the product. Market interventions and deadweight loss. Understand why price controls result in deadweight loss. The loss in social surplus that occurs when the economy produces at an inefficient quantity is called deadweight loss. (summary of book) markets in action price ceilings a price ceiling is a government regulation of the deadweight loss is defined as the loss of economic efficiency. In other words, it is the cost born by society due to market inefficiency. Deadweight loss канала marginal revolution university. The total of lost consumer and producer surplus when not all mutually profitable gains from trade are exploited. Price ceilings can be advantageous in allowing economists worry that price ceilings cause a deadweight loss to an economy, making it more the opposite of a price ceiling is a price floor, which sets a minimum price at which a product or service.

2021 Cfa Level I Exam Learning Outcome Statements

Deadweight Loss Definition 3 Examples And Causes Boycewire. The loss in social surplus that occurs when the economy produces at an inefficient quantity is called deadweight loss. The price increase created by a price floor will increase the total amount paid by buyers when the demand is inelastic, and otherwise will reduce the the deadweight loss is illustrated in figure 5.7 a price ceiling, and again represents the loss associated with units that are valued at more than they. The imposition of a price floor or a price ceiling will prevent a market from adjusting to its equilibrium price and quantity, and thus will create an inefficient outcome. When prices are controlled, the mutually profitable gains from free trade cannot be fully realized, creating deadweight loss. There are a number of options In this video, we explore the fourth unintended consequence of price ceilings: In this video, we explore the fourth unintended consequence of price ceilings: When a price ceiling is set below the equilibrium price, quantity demanded will exceed quantity supplied, and excess demand or shortages will result. What shall the government do with all the surplus wheat? A price floor is the lowest possible selling price, beyond which the seller is not willing or not able (legally) to sell the product. Determining the deadweight loss helps to see how much money companies missed out on based on new taxes, a price ceiling or price floor changes. Deadweight loss refers to a cost that stems from economic insufficiency wherein allocations are not balanced. Market interventions and deadweight loss. Price ceilings prevent a price from rising above a certain level. When prices are controlled, the mutually profitable gains.

Price Ceilings And Price Floors Article Khan Academy

Price Floor Market. There are a number of options Market interventions and deadweight loss. In this video, we explore the fourth unintended consequence of price ceilings: Price ceilings prevent a price from rising above a certain level. When prices are controlled, the mutually profitable gains from free trade cannot be fully realized, creating deadweight loss. When prices are controlled, the mutually profitable gains. Determining the deadweight loss helps to see how much money companies missed out on based on new taxes, a price ceiling or price floor changes. Deadweight loss refers to a cost that stems from economic insufficiency wherein allocations are not balanced. A price floor is the lowest possible selling price, beyond which the seller is not willing or not able (legally) to sell the product. What shall the government do with all the surplus wheat? In this video, we explore the fourth unintended consequence of price ceilings: The loss in social surplus that occurs when the economy produces at an inefficient quantity is called deadweight loss. The imposition of a price floor or a price ceiling will prevent a market from adjusting to its equilibrium price and quantity, and thus will create an inefficient outcome. The price increase created by a price floor will increase the total amount paid by buyers when the demand is inelastic, and otherwise will reduce the the deadweight loss is illustrated in figure 5.7 a price ceiling, and again represents the loss associated with units that are valued at more than they. When a price ceiling is set below the equilibrium price, quantity demanded will exceed quantity supplied, and excess demand or shortages will result.

A Binding Price Ceiling Causes

Price Floor Market. There are a number of options Deadweight loss refers to a cost that stems from economic insufficiency wherein allocations are not balanced. When a price ceiling is set below the equilibrium price, quantity demanded will exceed quantity supplied, and excess demand or shortages will result. A price floor is the lowest possible selling price, beyond which the seller is not willing or not able (legally) to sell the product. The price increase created by a price floor will increase the total amount paid by buyers when the demand is inelastic, and otherwise will reduce the the deadweight loss is illustrated in figure 5.7 a price ceiling, and again represents the loss associated with units that are valued at more than they. Market interventions and deadweight loss. When prices are controlled, the mutually profitable gains. What shall the government do with all the surplus wheat? Determining the deadweight loss helps to see how much money companies missed out on based on new taxes, a price ceiling or price floor changes. In this video, we explore the fourth unintended consequence of price ceilings: When prices are controlled, the mutually profitable gains from free trade cannot be fully realized, creating deadweight loss. The loss in social surplus that occurs when the economy produces at an inefficient quantity is called deadweight loss. Price ceilings prevent a price from rising above a certain level. In this video, we explore the fourth unintended consequence of price ceilings: The imposition of a price floor or a price ceiling will prevent a market from adjusting to its equilibrium price and quantity, and thus will create an inefficient outcome.

Solved If A Price Ceiling Of 8 Were Placed In The Market Chegg Com

Chapter 8 Shortage Prices. The price increase created by a price floor will increase the total amount paid by buyers when the demand is inelastic, and otherwise will reduce the the deadweight loss is illustrated in figure 5.7 a price ceiling, and again represents the loss associated with units that are valued at more than they. A price floor is the lowest possible selling price, beyond which the seller is not willing or not able (legally) to sell the product. Market interventions and deadweight loss. When a price ceiling is set below the equilibrium price, quantity demanded will exceed quantity supplied, and excess demand or shortages will result. Deadweight loss refers to a cost that stems from economic insufficiency wherein allocations are not balanced. Determining the deadweight loss helps to see how much money companies missed out on based on new taxes, a price ceiling or price floor changes. In this video, we explore the fourth unintended consequence of price ceilings: The loss in social surplus that occurs when the economy produces at an inefficient quantity is called deadweight loss. Price ceilings prevent a price from rising above a certain level. There are a number of options In this video, we explore the fourth unintended consequence of price ceilings: When prices are controlled, the mutually profitable gains from free trade cannot be fully realized, creating deadweight loss. What shall the government do with all the surplus wheat? The imposition of a price floor or a price ceiling will prevent a market from adjusting to its equilibrium price and quantity, and thus will create an inefficient outcome. When prices are controlled, the mutually profitable gains.

2021 Cfa Level I Exam Learning Outcome Statements

Deadweight Loss Formula How To Calculate Deadweight Loss. Determining the deadweight loss helps to see how much money companies missed out on based on new taxes, a price ceiling or price floor changes. The price increase created by a price floor will increase the total amount paid by buyers when the demand is inelastic, and otherwise will reduce the the deadweight loss is illustrated in figure 5.7 a price ceiling, and again represents the loss associated with units that are valued at more than they. What shall the government do with all the surplus wheat? Market interventions and deadweight loss. When prices are controlled, the mutually profitable gains from free trade cannot be fully realized, creating deadweight loss. In this video, we explore the fourth unintended consequence of price ceilings: When prices are controlled, the mutually profitable gains. In this video, we explore the fourth unintended consequence of price ceilings: When a price ceiling is set below the equilibrium price, quantity demanded will exceed quantity supplied, and excess demand or shortages will result. The imposition of a price floor or a price ceiling will prevent a market from adjusting to its equilibrium price and quantity, and thus will create an inefficient outcome. Price ceilings prevent a price from rising above a certain level. Deadweight loss refers to a cost that stems from economic insufficiency wherein allocations are not balanced. The loss in social surplus that occurs when the economy produces at an inefficient quantity is called deadweight loss. There are a number of options A price floor is the lowest possible selling price, beyond which the seller is not willing or not able (legally) to sell the product.

Price Ceilings And Price Floors Article Khan Academy

Deadweight Loss Tutorial Sophia Learning. Market interventions and deadweight loss. A price floor is the lowest possible selling price, beyond which the seller is not willing or not able (legally) to sell the product. When a price ceiling is set below the equilibrium price, quantity demanded will exceed quantity supplied, and excess demand or shortages will result. In this video, we explore the fourth unintended consequence of price ceilings: Deadweight loss refers to a cost that stems from economic insufficiency wherein allocations are not balanced. When prices are controlled, the mutually profitable gains from free trade cannot be fully realized, creating deadweight loss. The imposition of a price floor or a price ceiling will prevent a market from adjusting to its equilibrium price and quantity, and thus will create an inefficient outcome. When prices are controlled, the mutually profitable gains. There are a number of options The price increase created by a price floor will increase the total amount paid by buyers when the demand is inelastic, and otherwise will reduce the the deadweight loss is illustrated in figure 5.7 a price ceiling, and again represents the loss associated with units that are valued at more than they. In this video, we explore the fourth unintended consequence of price ceilings: Determining the deadweight loss helps to see how much money companies missed out on based on new taxes, a price ceiling or price floor changes. Price ceilings prevent a price from rising above a certain level. What shall the government do with all the surplus wheat? The loss in social surplus that occurs when the economy produces at an inefficient quantity is called deadweight loss.

4 3 Government Intervention In The Market Price Floors And Price Ceilings Flashcards Quizlet

Solved If A Price Ceiling Of 8 Were Placed In The Market Chegg Com. Determining the deadweight loss helps to see how much money companies missed out on based on new taxes, a price ceiling or price floor changes. When prices are controlled, the mutually profitable gains. Deadweight loss refers to a cost that stems from economic insufficiency wherein allocations are not balanced. There are a number of options What shall the government do with all the surplus wheat? When a price ceiling is set below the equilibrium price, quantity demanded will exceed quantity supplied, and excess demand or shortages will result. The price increase created by a price floor will increase the total amount paid by buyers when the demand is inelastic, and otherwise will reduce the the deadweight loss is illustrated in figure 5.7 a price ceiling, and again represents the loss associated with units that are valued at more than they. The imposition of a price floor or a price ceiling will prevent a market from adjusting to its equilibrium price and quantity, and thus will create an inefficient outcome. In this video, we explore the fourth unintended consequence of price ceilings: In this video, we explore the fourth unintended consequence of price ceilings: The loss in social surplus that occurs when the economy produces at an inefficient quantity is called deadweight loss. Market interventions and deadweight loss. A price floor is the lowest possible selling price, beyond which the seller is not willing or not able (legally) to sell the product. When prices are controlled, the mutually profitable gains from free trade cannot be fully realized, creating deadweight loss. Price ceilings prevent a price from rising above a certain level.